Eastern Bankshares (NASDAQ:EBC) Has Affirmed Its Dividend Of $0.10

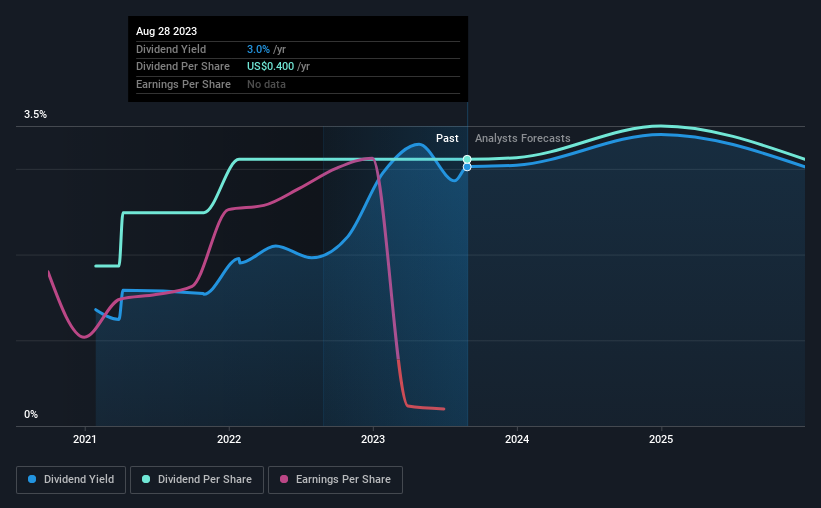

The executives of Eastern Bankshares, Inc. have declared that they will distribute a financial reward on September 15th. Stakeholders will be entitled to receive $0.10 for each share they own. Consequently, this implies that the yearly payout will amount to 3.0% of the present stock value, aligning with the typical rate within the sector.

Take a look at our most recent examination of Eastern Bankshares

Eastern Bankshares' Dividend Secure With Strong Earnings

We are not particularly impressed by the dividend yields unless they can be maintained consistently in the long run.

Eastern Bankshares has not been paying dividends for a long time, with its current track record spanning only 2 years. Although it is commendable that Eastern Bankshares has been making efforts to distribute dividends, their latest earnings report reveals that the company did not generate sufficient earnings to cover these dividends. This raises concerns among investors, indicating that Eastern Bankshares may not be able to sustain its dividends over the long run.

Experts anticipate a significant increase in the amount of money earned per share over the coming three years. Furthermore, they project that the percentage of earnings paid out as dividends will be 36% during this timeframe, assuring us of the dividend's long-term viability.

Eastern Bankshares: Building Track Record

When we examine the dividend history, we can see that it has remained quite consistent. However, it's important to note that the company has only recently started paying dividends. This lack of a long payment history makes it challenging to determine how well the company would perform throughout an entire economic cycle. Looking back to 2021, the annual dividend payment was $0.24. In comparison, the most recent full-year payment amounted to $0.40. This translates to a compound annual growth rate (CAGR) of around 29% per year during that period. It is certainly pleasing to witness such strong dividend growth. However, due to the limited payment history, we should be cautious in relying on it as a reliable indicator until a more extensive track record can be established.

Challenges In Attaining Dividend Growth

The stock's payment track record might lure investors in. However, we shouldn't hastily assume that everything is as rosy as it seems. Eastern Bankshares has experienced a decline in earnings per share by 2.7% annually within the past three years. Naturally, if the company is earning less over time, it will also distribute fewer dividends. Nevertheless, there is a glimmer of hope in the upcoming year, as earnings are projected to increase. It would be wise to wait until this becomes a consistent trend before getting overly enthusiastic.

Uncertain Future Of Eastern Bankshares' Dividend

In general, we believe that this company does not present itself as a profitable investment for dividends, despite the fact that the dividend payout remained unchanged this year. The company's past performance is not impressive, and the dividend payments appear to be too high to be sustainable. To sum up, we do not believe that this company possesses the qualities needed to be considered a reliable source of income for investors.

Investors typically prefer companies that have a reliable and steady dividend policy, rather than ones that have an inconsistent approach. However, there are additional aspects that our audience should consider before investing in a particular stock. For instance, we have discovered 1 red flag for Eastern Bankshares that you should take into account before making any investments. If you are someone who focuses on receiving dividends, you might also find our carefully selected compilation of high-yield dividend stocks worth exploring.

Do you have any thoughts about this article? Are you worried about what it says? Contact us directly to share your feedback. Alternatively, you can email the editorial-team at simplywallst.com.

The content of this blog post from Simply Wall St is broad in scope. We offer insight based on past information and expert predictions utilizing a fair approach. Please note that our articles are not meant to provide financial guidance and should not be seen as a suggestion to purchase or sell any stocks. Your goals and financial circumstances are not taken into consideration. Our goal is to provide in-depth analysis based on fundamental data with a focus on long-term perspectives. Be aware that our analysis may not incorporate the most recent price-sensitive updates or qualitative material from companies. Simply Wall St does not hold any positions in the mentioned stocks.