How India’s suspension of sugar exports will affect import-reliant Arab countries

Impact Of India's Halt On Sugar Exports On Arab Nations

RIYADH/DUBAI/NEW DELHI: Arab nations are preparing themselves for a substantial increase in the cost of sugary goods as it was revealed this week that India, a significant provider of agricultural products to the import-dependent Middle East region, intends to halt sugar exports from October until September of the following year.

As per three undisclosed officials from the Indian government who spoke to Reuters, New Delhi enforced a ban of 11 months. This unique measure, not implemented for the past seven years, was primarily a response to the diminished production of sugarcane resulting from insufficient rainfall during the summer monsoon period.

“This possible prohibition originates from insufficient precipitation in crucial sugarcane farming regions,” stated Pushan Sharma, head of research at CRISIL Market Intelligence and Analytics, in a conversation with Arab News.

Despite the fact that the amount of rain in the states where sugarcane is cultivated, namely Uttar Pradesh, Maharashtra, and Karnataka, was satisfactory during the summer, Sharma claims that certain significant districts experienced reduced rainfall. As a consequence, it is anticipated that the sugar yields for the 2023-24 season will be lower.

The decrease in manufacturing is a significant worry for the sugar sector as these regions solely contribute to over 50% of India's complete sugar production.

The decreased manufacturing in India and the nation's lack of participation in the global market will unquestionably lead to price hikes at a moment when sugar was already being traded at its highest levels in several years.

There are now growing concerns about a potential increase in global food prices, particularly in the Arab nations that heavily rely on India for their sugar supply.

According to Fadel El-Zubi, a prominent advisor for the United Nations Food and Agriculture Organization in Jordan, certain Arab nations will face difficulties in dealing with the sudden rise in prices. This predicament is expected to have an impact on their imports, available stock, and overall distribution procedure. Arab News reported these concerns expressed by El-Zubi.

"These nations in the Arab region will experience additional rise in prices, while their domestic currencies are already fragile." Consequently, these nations should adopt preemptive actions prior to expected disturbances in the food industry, he stated.

Arab nations will not be able to withstand upcoming shifts in prices "unless they begin to adopt an effective food system and progressively enhance their self-reliance."

According to El-Zubi, these nations should focus on enhancing their current production and reducing their reliance on imported food items, although achieving complete self-sufficiency may not be necessary.

El-Zubi foresees that there will be alterations in consumer behavior due to the sugar export halt, but he acknowledges that these changes cannot occur instantaneously.

India plans to halt the export of sugar from October 2023 until September 2024.

Countries in the Middle East are significant purchasers of sugar from India.

The relocation is anticipated to result in a surge in the cost of groceries in the Arab region.

The surge in crude oil prices in the past few years, which inevitably influenced the expense of transporting goods, had positioned India as a favored option for Middle Eastern buyers of sugar, considering its relatively close distance as compared to other prominent sugar producers like the distant Brazil.

However, countries in the Arab region, predominantly in North Africa, purchased around 10 percent of Brazil's sugar exports during the initial three months of 2023.

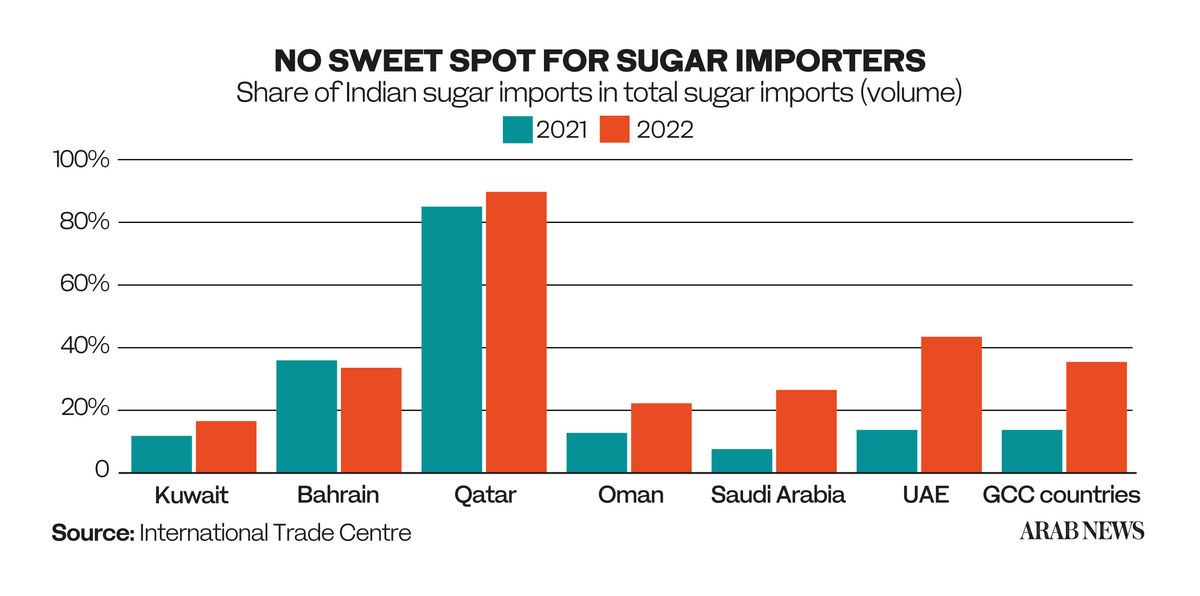

According to data from the International Trade Center, Qatar relied on India for 90 percent of its sugar imports, while the UAE depended on India for 43 percent, Bahrain for 34 percent, and Saudi Arabia and Kuwait for 28 percent each.

Sugar is a common component in Gulf Cooperation Council nations, making them particularly prone to increasing prices due to the suspension of exports.

According to Sharma, if India decides to stop exporting sugar, it would cause a decline in the global market's sugar supply. This, in turn, would result in increased prices for countries that rely on importing sugar, including all GCC nations.

And these nations will encounter difficulty in locating alternative or replacement sugar sources in the interim.

"Although these limitations will compel the Arab region to expand their options for procurement, switching suppliers will require a considerable amount of time," noted Anupam Manur, a professor's assistant affiliated with the Takshashila Institution located in Bangalore.

In the near future, there will be an increase in food inflation.

In spite of the anticipated consequences, the Indian authorities have determined that the prohibition was an indispensable measure.

"The ban takes into account internal factors. The government is considering the welfare of its own consumers," said Gokul Patnaik, who serves as the chairman of Global AgriSystem Pvt. Ltd. and previously held a position as the director of the Agricultural and Processed Food Products Export Development Authority, in an interview with Arab News.

Farmers and cultivators have the opportunity to earn additional income by raising prices. In the scenario of onions, the cultivators are directly impacted, whereas in the case of sugar (a processed commodity), the impact is more indirect. Nevertheless, regardless of the situation, it negatively impacts the growers in all instances.

Manur has noticed a consistent trend in India's agricultural trade policy. The repeated limitations on exports imposed by the government clearly demonstrate their focus on meeting domestic demand rather than maximizing export profits, according to him.

Retail inflation in India as a whole was a matter of worry lately, with the consumer price index surging to a 15-month peak of 7.44 percent in July, while food inflation reached 11.5 percent, marking its highest level in more than three years.

"Nevertheless, inflation stems from a combination of imbalances between supply and demand, as well as consumer anticipations," Manur stated.

Paradoxically, through implementing a sequence of limitations on exports, there is an unintentional indication of shortage being conveyed, which in turn has the potential to raise prices. Moreover, this course of action reduces the motivation for increased production at the edge.

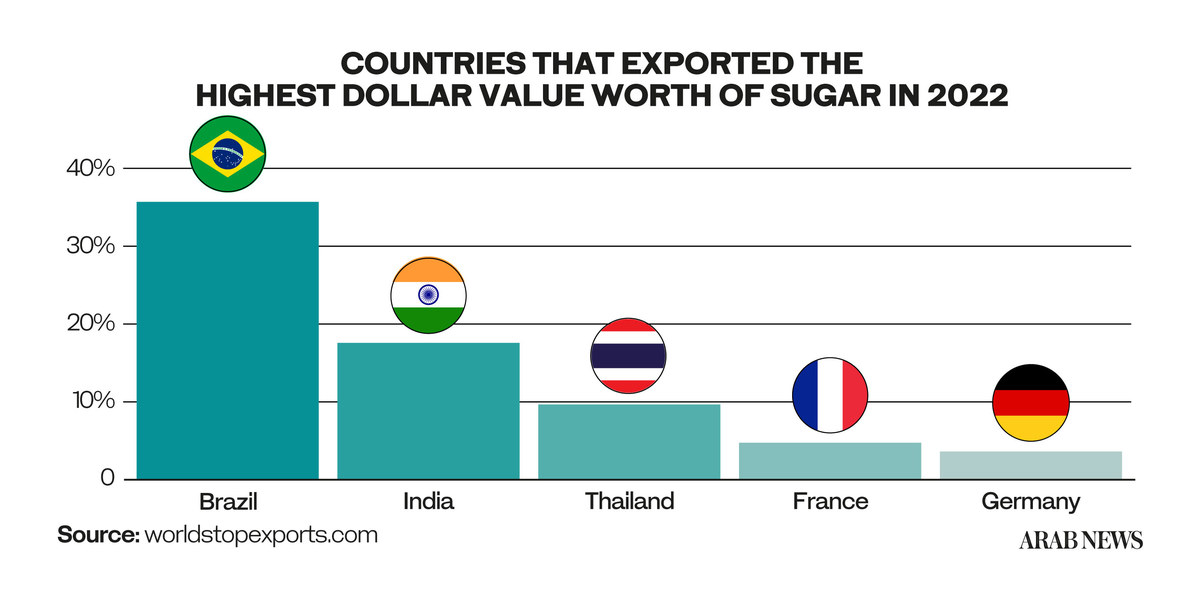

In recent times, India has emerged as one of the swiftly expanding sugar exporting nations. In the previous year, it secured the position of the second-largest exporter globally, with exports amounting to a staggering $5.7 billion. This marked a significant increase from the relatively meager sum of $810.9 million witnessed in 2017.

The surge in sugar exports from New Delhi can be credited to several factors, including beneficial weather conditions, a rise in domestic sugar production, and government initiatives advocating for sugar exports.

According to Sharma, India ranks as the second most significant sugar exporter in the world, following Brazil. This implies that India is responsible for 15 percent of all sugar exports worldwide.

Nevertheless, the export portion for the sugar season spanning from October 2022 to September 2023 is anticipated to decrease to 11% owing to a considerable decline in exports.

In the past few months, not only sugar but various other Indian food exports have also displayed their unreliability.

Last month, the nation astounded international buyers by implementing a prohibition on the export of non-basmati white rice. Additionally, a tariff of 40 percent was established on onion exports in an endeavor to stabilize the cost of food prior to the upcoming state elections.

Patnaik expressed concern over the impulsive decision to prohibit exports, emphasizing its negative impact on our livelihood as a consistent exporter. According to him, it would be preferable to make alterations to export taxes instead of implementing an outright ban.

"If you impose a prohibition, your trustworthiness as a reliable provider will diminish. The prohibition will undeniably have repercussions on the Arab region, as well as on India's reputation."

Manur agreed with this evaluation. "India could face difficulties in its trading relationships with its trade partners, which may lead to either retaliatory taxes or a weakened position in future trade negotiations," he noted.

Moreover, this situation could have detrimental effects on India in the future since numerous nations would rush to vary their sources of food.

In the immediate future, it may have a detrimental effect on less affluent nations in the Arab region, where ensuring access to sufficient food is already a worry, particularly due to the ongoing conflict between Russia and Ukraine. This conflict poses a risk to the grain shipments from these countries to key importers.

Developing countries in the region lack the necessary financial resources to manage the rise in food prices, unlike sugar-importing nations such as the UAE, which have sufficient economic support.