The Bull Case for Oil Prices (5 Catalysts)

The oil industry has been experiencing fluctuations in the past few months. Nevertheless, there are five catalysts that indicate giving up on the sector should not be done too soon.

The Strategic Petroleum Reserve has been depleted.

The U.S. government has a reserve of crude oil called the Strategic Petroleum Reserve (SPR) that is used for emergencies when there are disruptions in oil supply or significant price increases. However, over the past three years, there has been a large decrease in the amount of crude oil in the SPR. It has reduced from over 650 million barrels to about 350 million barrels. This decrease can initially lead to more oil supply and lower oil prices. But in the long term, it creates a smaller cushion of supply. This means that if oil prices increase, the U.S. government will have to buy oil at a higher price to refill the reserve. This is similar to when a short squeeze happens, which means investors rush to buy stocks to avoid losing money.

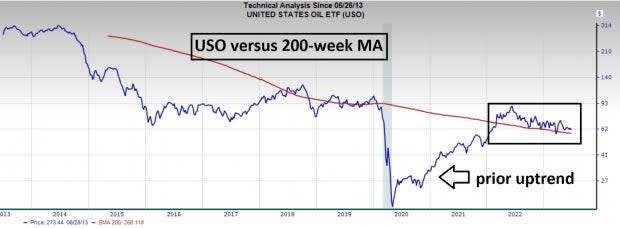

The level at which the price of an asset tends to stop decreasing and instead starts to rise again is known as a support level. Resistance levels, on the other hand, mark price levels where an asset tends to stop increasing and instead starts to drop. Occasionally, these levels can shift. A previous resistance level can transform into a support level once the asset price breaks through the resistance level and moves higher. When an asset price returns to the previous resistance level and hesitates at that level, it is referred to as testing the level. If the price continues to rise from there, the previous resistance level becomes the new support level. This technical analysis is often used to identify potential buying opportunities in the market.

One of the key things that technical analysts try to spot is when a resistance level suddenly becomes a support level. For long-term investors, the 200-week moving average is an important tool to rely on for support. Over the years, the United States Oil ETF (USO) had surpassed this level during the years 2018 and 2019, but was unable to maintain it. Nevertheless, at the start of 2022, oil once again exceeded this moving average and has remained above it since then. This shows that bullish investors are determined to defend this level.

The blog post was originally written in a formal style, and now I will rewrite it in more informal English. Hey, check out this cool picture from Zacks Investment Research! It's from a blog post they wrote about the stock market. The article was pretty fancy, but let me put it in simpler terms. Zacks says that there are a lot of things that can affect the stock market. For example, news about big companies can make the prices go up or down. If people think a company is doing well, they will be more likely to buy its stock, which makes the price go up. But if people hear bad things, they might want to sell the stock, which makes the price go down. Another thing that affects the stock market is the general state of the economy. If things are going well, people will be more likely to invest in the stock market. But if there is a recession or something, people might be too nervous to invest. These are just a few examples of the stuff that can change the stock market. It's a complex system, but if you keep an eye on the news and do your research, you can make some good investments. Happy trading!

Since OPEC controls a large portion of the world's oil supply, their decision to reduce output can significantly increase the cost of oil. Recently, they declared that they intend to implement drastic cuts to their production and hope to maintain this limited supply until the end of 2023.

It seems like the world's political situation is still causing turmoil with no end in sight. Recent events over the weekend saw a Russian private military group, Wagner, allegedly try to overthrow its own leader, Vladimir Putin. However, the attempt was quickly stopped. Despite the confusing details, an explosion at a fuel depot in Russia is believed to be related to the coup. This instability is already affecting the oil industry, and it's unlikely we'll see any resolution anytime soon. More disruptions to oil production are expected as we wait for peace to reign.

The prices of goods or services are currently at a discounted rate, making them a great value for customers to purchase.

Even though some oil stocks haven't seen any price changes in a long time, their value is becoming more appealing. Occidental Petroleum (OXY) is an example of this, as their price-to-sales ratio is getting close to record lows. Back in 2016, the p/s ratio for OXY was 5.5, but now it is only 1.54. Smart investors, such as Warren Buffett, have started to pay attention to this and have bought up large amounts of inexpensive oil stocks like OXY. OXY's p/e ratio is also lower than that of the S&P 500.

Picture Credit: Zacks Investment Investigation

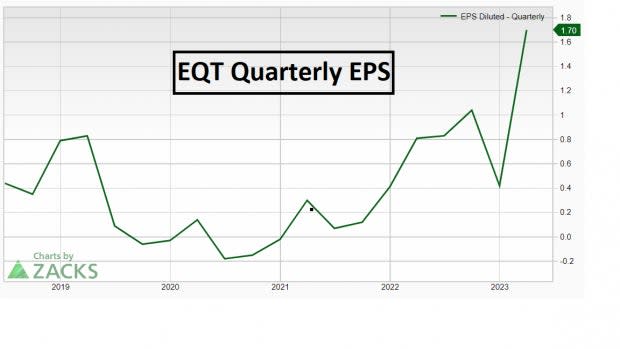

EQT Corp (EQT) is currently considered the most potent petroleum and gas firm in the domestic market. Other American oil stocks have stayed stagnant, failing to cross their 200-day moving averages. However, EQT has been on an upward trajectory in recent months.

The picture used in this blog post was obtained from Zacks Investment Research.

EQT also has remarkable earnings growth in the hundreds.

The part of the blog article will be rephrased using diverse vocabulary and simplified language: Picture Credit: Zacks Asset Study The writer of the blog section will be paraphrased using dissimilar words and an effortless style: Image Origin: Zacks Investment Probe.

While energy companies in the home country have appealing prices, the foreign oil producers have shown great price advancements. One such example is the YPF Sociedad Anonima (YPF) from Argentina, which has been ranked #2 (Buy) by Zacks. Despite low oil prices, YPF has shown outstanding strength in comparison and has surpassed its previous records by breaking out of a multi-month base structure.

The featured image in this blog post was obtained from Zacks Investment Research.

Even though inflation has been a major issue for Argentina, its stocks and the MSCI Argentina ETF (ARGT) have still managed to perform incredibly well in terms of equity. It's worth keeping an eye on Ecopetrol (EC), an energy producer based in Colombia, particularly if the cost of oil goes up.

While the cost of oil has been unpredictable lately, you shouldn't let recent events cloud your judgement. Factors like worries around supply, political unrest, and the overall technical trends indicate that the price of oil could be on the rise again soon. Although American oil companies seem like a good investment, foreign oil companies tend to perform better in terms of both price and production.

Looking for the most recent advice from Zacks Investment Research? At present, you have the chance to obtain 7 top-performing stocks for the coming month, available for download. Simply click to access this complimentary report.

Observe petroleum focused enterprise, Occidental Petroleum Corporation (OXY): Obtain a stock analysis report free of charge.

The Free Stock Analysis Report for EQT Corporation (EQT) is now available. Get complete insights into the performance of EQT, including its financials and other crucial details. The report provides comprehensive data on EQT's growth and profitability, making it a useful resource for investors looking to make informed investment decisions. Download the Free Stock Analysis Report for EQT Corporation (EQT) right away!

Looking for a report on the performance of Ecopetrol S.A. (EC)? Check out their Free Stock Analysis Report now available.

YPF Sociedad Anonima, also known as YPF, presents their Free Stock Analysis Report.

The ETF Research Reports section covers the United States Oil ETF (USO) in the following blog post.

The latest report on Global X MSCI Argentina ETF (ARGT): ETF Research Reports is now available. This report provides in-depth analysis and insight on the performance of the ARGT ETF, which invests in companies based in Argentina as per the MSCI Argentina Index. This report will help you make informed decisions about your investment choices, with valuable information about the ETF's holdings, performance data, and overall market trends. Stay up-to-date with the latest insights on investing in Argentina with the ARGT ETF Research Reports.

If you want to access this piece of writing on Zacks.com, just click on the provided link.